« How good are your estimation skills? | Main | BDRM June 15-17th 2006 »

May 29, 2006

Would you throw good money after bad?

THE PSYCHOLOGY OF SUNK COST

Hal Arkes and Catherine Blumer asked a group of 48 people the following scenario involving sunk costs:

As the president of an airline company, you have invested 10 million dollars of the company’s money into a research project. The purpose was to build a plane that would not be detected by conventional radar, in other words, a radar-blank plane. When the project is 90% completed, another firm begins marketing a plane that cannot be detected by radar. Also, it is apparent that their plane is much faster and far more economical than the plane your company is building. The question is: should you invest the last 10% of the research funds to finish your radar-blank plane, yes or no?

Then asked another group of 60 people this very similar scenario, which one will notice has no sunk costs:

As president of an airline company, you have received a suggestion from one of your employees. The suggestion is to use the last 1 million dollars of your research funds to develop a plane that would not be detected by conventional radar, in other words, a radar-blank plane. However, another firm has just begun marketing a plane that cannot be detected by radar. Also, it is apparent that their plane is much faster and far more economical than the plane your company could build. The question is: should you invest the last million dollars of your research funds to build the radar-blank plane proposed by your employee?

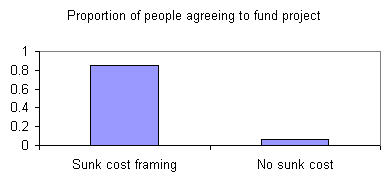

Which did people choose?

Researchers refer to this phenomenon as the "sunk cost effect ... manifested in a greater tendency to continue an endeavor once an investment in money, effort, or time has been made." One could argue that the decision to complete the project shouldn't be influenced by the information which differs between the sunk cost and non-sunk cost scenarios, and yet the data show that the framing matters very much to people.

To see 9 (!) other studies on the sunk cost effect, some involving real-world decisions such as to use pre-paid season tickets, see Arkes and Blumer, below.

Reference:

Arkes, H. R. & Blumer C. (1985). The Psychology of Sunk Cost. Organizational Behavior and Human Decision Processes, 35, 124-140.

Posted by dggoldst at May 29, 2006 11:52 AM