« July 2004 | Main | September 2004 »

August 24, 2004

Fame at last

FAST AND FRUGAL IN THE NEW YORKER

The catchiest of the concepts I've coined, "fast and frugal reasoning", has made the New Yorker!

The Unpolitical Animal by Louis Menand

The author doesn't use it quite correctly, but one can't ask for everything I suppose. The fast and frugal heuristics I came up with do reason well in real-world environments.

I came up with the term in 1994 or so, it first appeared in print here: Gigerenzer, G. & Goldstein, D. G. (1996). Reasoning the fast and frugal way: Models of bounded rationality. Psychological Review, 103, 650-669.

Posted by dggoldst at 03:06 PM | Comments (0) | TrackBack

August 23, 2004

A Model of Reference-Dependent Preferences

MODELING PREFERENCES THAT RESPECT REFERENCE POINTS

Reference-dependent preferences are everywhere. A working paper by Berkeley's Botond Koszegi and Matt Rabin provides a welcome model of them. Read on.

Quote:

"Our goal in this paper was to put forward a fully specified model of reference dependent preferences that can accommodate existing evidence and, most importantly, be applied to a wide range of economic situations. The centerpiece of our model is the proposal that a person's reference point is her recent probabilistic beliefs about the outcomes she is going to get. Thus, for example, if she expects improvements in her circumstances, and these changes fail to occur, she experiences a painful sensation of loss, even if she has retained or improved on her status quo. Indeed, our model provides an avenue to study an intuition about the strong role that expectations play in employee satisfaction with wages; it predicts both a status quo bias in stagnant environments, and a taste for improvement in environments where workers have become accustomed to improvement."

Abstract:

"We develop a model that fleshes out, extends, and modifies existing models of reference dependent preferences and loss aversion while accomodating most of the evidence motivating these models. Our approach makes reference-dependent theory more broadly applicable by avoiding some of the ways that prevailing models—if applied literally and without ancillary assumptions—make variously weak and incorrect predictions. Our model combines the reference-dependent gain-loss utility with standard economic consumption utility and clarifies the relationship between the two. Most importantly, we posit that a person's reference point is her recent expectations about outcomes (rather than the status quo), and assume that behavior accords to a personal equilibrium: The person maximizes utility given her rational expectations about outcomes, where these expectations depend on her own anticipated behavior. We apply our theory to consumer behavior, and emphasize that a consumer's willingness to pay for a good is endogenously determined by the market distribution of prices and how she expects to respond to these prices. Because a buyer's willingness to buy depends on whether she anticipates buying the good, for a range of market prices there are multiple personal equilibria. This multiplicity disappears when the consumer is sufficiently uncertain about the price she will face. Because paying more than she anticipated induces a sense of loss in the buyer, the lower the prices at which she expects to buy the lower will be her willingness to pay. In some situations, a known stochastic decrease in prices can even lower the quantity demanded."

Full article available for download

Related Books:

*Colin F. Camerer, George Loewenstein & Matthew Rabin (Eds.) (2004). Advances in Behavioral Economics.

*Daniel Kahneman & Amos Tversky (Eds.) (2000). Choices, Values, and Frames.

Posted by DSN at 03:20 PM | Comments (0)

August 19, 2004

Richard H. Thaler

DECISION SCIENCE RESEARCHER PROFILE: RICHARD H. THALER

Richard Thaler is the Robert P. Gwinn Professor of behavioral science and economics at University of Chicago. He currently serves as the director of the Center for Decision Research, and is a research associate at the National Bureau of Economic Research and co-director of the project on behavioral economics. His research focuses on behavioral economics and finance, as well as the psychology of decision making. He has served as a visiting professor at the Sloan School of Management, Massachusetts Institute of Technology, as well as the H. J. Louis Professor of Economics, Johnson Graduate School of Management, Cornell University. Dr. Thaler earned his B.A. in economics from Case Western Reserve University and his Ph.D. in economics from the University of Rochester.

Current Positions:

*Robert P. Gwinn Professor of Behavioral Science and Economics, and Director of the Center for Decision Research, Graduate School of Business, University of Chicago.

*Research Associate, National Bureau of Economic Research (co-director -with Robert Shiller- of the Behavioral Economics Project, funded by the Russell Sage Foundation)

Recent Academic History:

*January 1988-June 1995: Henrietta Johnson Louis Professor of Economics, Johnson Graduate School of Management, Cornell University and Director, Center for Behavioral Economics and Decision Research

*Septeber 1994-June 1995: Visiting Professor, Sloan School of Management, MIT

*January 1993-July 1993: Visiting Scholar, Sloan School of Management, MIT

*September 1991-July 1992: Visiting Scholar, Russell Sage Foundation, New York, NY

Quotes:

"I am an economist by training, but for the last 25 years I have been exploring ways to incorporate the findings of modern psychology into economic analysis."

"As firms switch from defined-benefit plans to defined-contribution plans, employees bear more responsibility for making decisions about how much to save. The employees who fail to join the plan or who participate at a very low level appear to be saving at less than the predicted life cycle savings rates. Behavioral explanations for this behavior stress bounded rationality and self-control and suggest that at least some of the low-saving households are making a mistake and would welcome aid in making decisions about their saving".

"We tend to think others are just like us. My colleague, George Wu, asked his students two questions: Do you have a cell phone? What percentage of the class has a cell phone? Cell phone owners thought 65 percent of the class had mobile phones, while the immobile phoners thought only 40 percent did. The right answer was about halfway in between. The false consensus effect will trap me into thinking that other economists will agree with me, 20 years of contrary evidence notwithstanding."

Selected Books:

* Richard Thaler (1991). Quasi-Rational Economics. Russell Sage Foundation.

* Richard Thaler (1991). The Winner's Curse: Paradoxes and Anomalies of Economic Life. Free Press.

* Richard Thaler (ed.) (1993). Advances in Behavioral Finance, editor. Russell Sage Foundation.

Selected Articles:

* Barberis , Nicholas and Richard H. Thaler (2003), A Survey of Behavioral Finance. In Handbook of the Economics of Finance. George M. Constantinides, Milton Harris, and Rene Stultz editors. Elsevier Science, North Holland, Amsterdam.

* Lamont, Owen and Richard Thaler, (2003), Can the Market Add and Subtract? Mispricing in Tech Stock Carve-Outs , Journal of Political Economy. 111(2): 227-268

* Benartzi , Shlomo, and Richard Thaler, (2002), How Much Is Investor Autonomy Worth? Journal of Finance Vol. 57.4, pp. 1593-1616.

* Benartzi, S.and Thaler, R., 2004, Save More Tomorrow: Using Behavioral Economics to Increase Employee Savings, Journal of Political Economy, Vol. 112:1, 164-187.

Other Interests:

Tennis, skiing, wine.

Read more:

Richard H. Thaler's Home page at the Univerity of Chicago

Richard H. Thaler's Activity page at the University of Chicago

Posted by DSN at 12:47 PM | Comments (0)

August 17, 2004

Gerd Gigerenzer

DECISION SCIENCE RESEARCHER PROFILE: GERD GIGERENZER

Gerd Gigerenzer is Director of the Center for Adaptive Behavior and Cognition at the Max Planck Institute for Human Development in Berlin and former Professor of Psychology at the University of Chicago. He won the AAAS Prize for the best article in the behavioral sciences.

Recent Career:

1997-Present Director (Managing Director, 2000-2001) Max Planck Institute for Human Development, Berlin

1995-1997 Director Max Planck Institute for Psychological Research, Munich

1992-1995 Professor, Department of Psychology, and Committee for the Conceptual Foundations of Science University of Chicago, USA

1990-1992 Professor of Psychology University of Salzburg, Austria

1984-1990Professor of Psychology University of Konstanz (Chairman, 1988-1989)

1982-1984 Privat-Dozent Department of Psychology, University of Munich

1977-1982 Assistant Professor Department of Psychology, University of Munich

Selected Books Published:

*Calculated Risks: How To Know When Numbers Deceive You, the German translation of which won the Scientific Book of the Year Prize in 2002.

Gerd Gigerenzer has also published two books on simple Hueristics:

* Simple Heuristics That Make Us Smart (with Peter Todd & The ABC Research Group) and

* Bounded Rationality: The Adaptive Toolbox (with Reinhard Selten, a Nobel laureate in economics).

* Adaptive Thinking: Rationality in the Real World

* The Empire of Chance : How Probability Changed Science and Everyday Life

Selected Honors and Awards:

*Batten Fellow, Darden Business School, University of Virginia, Charlottesville, 2004.

*Visiting professor, University of Munich, 2004.

*2003 Reckoning with Risk shortlisted for the Aventis Prize for Science Books

*2002 Science Book of the Year Prize for Einmaleins der Skepsis (German translation of Calculated Risks), awarded by bild der wissenschaft

Quotes:

"What interests me is the question of how humans learn to live with uncertainty. Before the scientific revolution determinism was a strong ideal. Religion brought about a denial of uncertainty, and many people knew that their kin or their race was exactly the one that God had favored. They also thought they were entitled to get rid of competing ideas and the people that propagated them. How does a society change from this condition into one in which we understand that there is this fundamental uncertainty? How do we avoid the illusion of certainty to produce the understanding that everything, whether it be a medical test or deciding on the best cure for a particular kind of cancer, has a fundamental element of uncertainty?"

"Isn't more information always better?" asks Gerd Gigerenzer. "Why else would bestsellers on how to make good decisions tell us to consider all pieces of information, weigh them carefully, and compute the optimal choice, preferably with the aid of a fancy statistical software package? In economics, Nobel prizes are regularly awarded for work that assumes that people make decisions as if they had perfect information and could compute the optimal solution for the problem at hand. But how do real people make good decisions under the usual conditions of little time and scarce information?"

Gerd Gigerenzer's Home Page at the Max Planck Institute

Dissertations:

*Gigerenzer, G. (1982). Messung und axiomatische Modellbildung: Theoretische Grundlagen und experimentelle Untersuchungen zur sensorischen und sozialen Wahrnehmung. Habilitationsschrift, Munich.

*Gigerenzer, G. (1977). Nonmetrische multidimensionale Skalierung als Modell des Urteilsverhaltens. Zur Integration von dimensionsanalytischer Methodik und psychologischer Theorienbildung. Dissertation, Munich.

Gerd Gigerenzer Profile continued...

Posted by DSN at 04:54 PM | Comments (0)

August 16, 2004

The Social Dilemma of Exaggerating the Positive

THE SOCIAL DILEMMA OF EXAGERATING THE POSITIVE-OF PEOPLE AND OF POLICIES

Imagine you are invited to a party with ten strangers and asked to play an unusual game. Upon arrival you are presented with a choice. You can either 1) choose to receive $10 now, which you may keep, or 2) choose to receive $20, which you must entirely give away by evenly dispersing $2 dollars to each of the other 10 strangers.

If everyone votes for (2), everyone leaves with $20. However, if only you vote for (2) and everybody else votes (1), they leave with $12 each, and you leave with nothing. Many other combinations of votes are possible.

Carnegie Mellon professor Robyn Dawes speculates on this problem ...

Now suppose that this game is repeated over a number of trials. What happens? Many colleagues around the world and I have conducted similar games, and the results are quite predictable. Especially if people are able to communicate with each other and make commitments prior to the first trial, almost all give the money away. But what happens on later trials where people know what they did on the previous trial and can infer from their payoff what other people did collectively? The rate of cooperation (giving) over trials is highly predictable. If this rate does not reach 100% on the first trial, some people note that they are making less money than those who keep their $10 stake and they then switch from being cooperators to being defectors. Subsequently, more people do so, often at an accelerating rate. By the end of ten trials, virtually no one is giving away the money. What has happened is that behavior has stabilized on the sink of universal defection. The one exception is that if people do not find out what happened after the first trial, where generally a majority honor the commitments to cooperate, subjects avoid the sink. When a few people know, however, that they are being "suckered" by others when they give away their $10 they stop doing it. (It is even possible to "reset" the situation by having an additional discussion prior to some trial, but even then over trials without discussion, the group ends up in the sink.)

An observer looking at behavior at the beginning of this degenerating process and ascribing the results to personality characteristics would conclude that people are altruistic and cooperative, while someone observing the end of the process and making similar personality attributions would conclude that people are generally selfish and uncooperative. But it is the situation itself that yields the behavior, at least on the part of anyone attempting to behave "rationally".

Posted by DSN at 03:02 PM | Comments (0)

August 11, 2004

IQ or Financial Incentives?

HOW FINANCIAL INCENTIVES AND COGNITIVE ABILITIES AFFECT TASK PERFORMANCE IN LABORATORY SETTINGS

Ondrej Rydval and Andreas Ortmann have a paper forthcoming in Economic Letters in which they re-analyze some data from Gneezy and Rustichini (2000) and look at the relative importance of financial incentives and cognitive capabilities on reasoning tasks.

The various NIS levels reflect the level of payment incentive (New Israeli Shekels, get it?) used by Gneezy and Rustichini (2000).

Rydval and Ortmann give the following interpretation:

"First of all, notice that the performance curves for the high-incentive treatments (NIS1 and NIS3) are virtually identical and slope considerably upwards, implying that there is a high within-treatment variation in performance but hardly any across-treatment one. Arguably, this is most likely due to a significant within-treatment variation in cognitive abilities. One could conceive that the large within-treatment performance variation is partly also effort-driven, but the variation in cognitive effort required to generate this result is unlikely; plus one would need to explain why the two performance curves seem almost identical despite the across-treatment incentive (and thus presumably effort) differential. Therefore, consistent with the interpretation of the IQ score as ability rank, it seems quite plausible that ability rather than incentive differentials determine individual performance differentials when incentives are high enough.

Next inspect the performance curves for the low-incentive treatments (no-pay and NIS0.1). Clearly, Gneezy and Rustichini (2000) were right in asserting that the NIS0.1 subjects overall were less motivated than the ones in the no-pay treatment. This is particularly apparent at the low-performance end where the gap between the performance curves for the low-incentive treatments widens (and, in addition, so does the gap between the performance curves of the two low-incentive treatments and the two high-inventive treatments). That the NIS0.1 subjects were less motivated than the ones in the no-pay treatment also seems confirmed by the performance curve for the NIS0.1 treatment lying below that for the no-pay treatment across the whole performance range. It is highly unlikely that this would be caused by across-treatment ability differentials, and thus across-treatment differences in motivation must have played the main role.

Finally and most importantly, focus on the slope of all four performance curves and the distance between them. An eyeball test reveals that, leaving aside the motivational problems at the low-performance end, the within-treatment variation in performance is generally much greater than the variation across treatments. To give a meaningful comparison, consider the largest across-treatment performance differential at the median rank. This turns out to be 13 (i.e., 24 correct answers in the NIS0.1 treatment vs. 37 in the NIS1 treatment), which is equivalent to the performance differential associated with moving up from the first to the third quartile within the NIS1 treatment (28 vs. 41). Note, however, that within-treatment performance differentials can be much larger. For instance, in both of the high-incentive treatments (NIS1 & NIS3), the difference in performance for individuals ranked 1 and 40 is as large as 34."

Reference

Gneezy, U. & Rustichini, A. (2000). Pay enough or don't pay at all, Quarterly Journal of Economics 115, 791-811.

Posted by dggoldst at 10:43 AM | Comments (0)

August 06, 2004

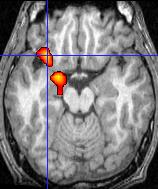

The Orbitofrontal Cortex, Regret and Decision Formation

THE INVOLVEMENT OF THE ORBITOFRONTAL CORTEX IN THE EXPERIENCE OF REGRET

The study of decision making would be incomplete without consideration of the role of regret. A recent article seeks its place in the brain.

The orbitofrontal cortex is a small area of the brain that is located just behind the eyes. It is involved in cognitive and affective functions such as assessing emotional significance of events, anticipating rewards and punishments, adjusting behaviors to adapt to changes in rule contingencies, and inhibiting inappropriate behaviors.

A recent article in Science discusses neural responses associated with regret in gambling tasks.

Abstract

Facing the consequence of a decision we made can trigger emotions like satisfaction, relief, or regret, which reflect our assessment of what was gained as compared to what would have been gained by making a different decision. These emotions are mediated by a cognitive process known as counterfactual thinking. By manipulating a simple gambling task, we characterized a subjects choices in terms of their anticipated and actual emotional impact. Normal subjects reported emotional responses consistent with counterfactual thinking; they chose to minimize future regret and learned from their emotional experience. Patients with orbitofrontal cortical lesions, however, did not report regret or anticipate negative consequences of their choices. The orbitofrontal cortex has a fundamental role in mediating the experience of regret.

Exerpt

"Previous work implicating the orbitofrontal cortex in emotion-based decision making principally emphasized bottom-up influences of emotions on cortical decision processes. We propose a different role whereby the orbitofrontal cortex exerts a top-down modulation of emotions as a result of counterfactual thinking, after a decision has been made and its consequences can be evaluated. As shown by the model of choice, the feeling of responsibility for the negative result, i.e., regret, reinforces the decisional learning process. The orbitofrontal cortex integrates cognitive and emotional components of the entire process of decision making; its incorrect functioning determines the inability to generate specific emotions such as regret, which has a fundamental role in regulating individual and social behavior."

Posted by DSN at 07:22 PM | Comments (0)

August 02, 2004

Brunswik Society 20th Annual International Meeting

20TH ANNUAL INTERNATIONAL MEETING OF THE BRUNSWIK SOCIETY

The 20th Annual International Meeting of the Brunswik Society will be held on Thursday and Friday, November 18-19, 2004 in Minneapolis, MN, at the Millennium Hotel. The program begins at 1:30 on Thursday afternoon. We invite proposals for papers on your recent research and panel discussions on any theoretical or empirical/applied topic related to Egon Brunswik's philosophy and paradigm.

Please send a brief abstract (50 words), and indicate whether the paper/discussion is theoretical or empirical, to Jim Holzworth by Friday,July 16th. Kindly respect this submission due date.

The organizing committee is:

Jim Holzworth holz@uconn.edu

Mandeep K. Dhami mkdhami@uvic.ca

Elise Weaver eweaver@wpi.edu

Tom Stewart t.stewart@albany.edu

The meeting is held concurrently with the Psychonomic Society Annual Meeting and just before The Society for Judgment and Decision Making meeting. More details about the 12 2004 meeting, including registration instructions, will be posted on the Brunswik Society website, http://brunswik.org.

Posted by DSN at 05:02 PM | Comments (0)

The Power of Predictive Markets

A recent article in The Journal of Economic Perspectives by Justin Wolfers and Eric Zitzewitz describes how a new kind of market for prediction and forecasting delivers surprisingly accurate results in a variety of domains.

Here, we see predicted versus actual movie opening takes, based on data from the Hollywood Stock Exchange.

Exerpt from article:

These insights suggest that some prediction markets will work better when they concern events that are widely discussed, since trading on such events will have higher entertainment value and there will be more information on whose interpretation traders can disagree. Ambiguous public information may be better in motivating trade than private information, especially if the private information is concentrated, since a cadre of highly informed traders can easily drive out the partly informed, repressing trade to the point that the market barely exists. Indeed, attempts to set up markets on topics where insiders are likely to possess substantial information advantages have typically failed.

Reference:

Wolfers, J. & Zitzewitz, E. Prediction Markets. The Journal of Economic Perspectives, 18(2),107-126

Posted by dggoldst at 10:38 AM | Comments (0)

August 01, 2004

Robyn Dawes

DECISION SCIENCE RESEARCHER PROFILE: ROBYN DAWES

Recent Career:

1997-Present The Charles J. Queenan, Jr. University Professor, Carnegie Mellon University.

1995-1996 Acting Head, Dept. of Social & Decision Sciences, Carnegie Mellon University

1994 Fellow, Center for Rationality & Interactive Decision Making, Hebrew University of Jerusalem,

1992-Present University Professor, Carnegie Mellon University (CMU)

1990-Present Professor of Psychology, Department of Social & Decision Sciences, CMU

Selected Books Published

* Rational Choice in an Uncertain World

* House of Cards

Quotes:

"My current research spans five areas: intuitive expertise, human cooperation, retrospective memory, methodology and United States AIDS policy. [...] I write journal articles and books because I believe the information they contain could be valuable -- at least on a "perhaps, maybe" basis. I have never written anything with the expectation that it will sell, or become a '"citation classic" (although one of my articles has). I believe that in American culture we are obsessed with outcomes rather than with behaving in ways that tend to bring about the best expected outcomes, while "time and chance" play a very important role. [...] Some of my clinical colleagues claim that feelings are not understood until they can be put into words. My own view is that every translation of a feeling, thought, idea or mathematical form into words involves at least a small element of automatic distortion, often a much larger element.

"We observe more human cooperation than can be readily inferred from a game theoretic analysis that assumes people are = selfish. I have long been dubious that we can "rescue" this analysis by extending it to include "side payments" (e.g. reciprocal altruism, concern with reputation, utility for acting in accord with a socially instilled conscience, benefit to those genetically related."

Selected Publications

Dawes, R.M. (2001) Everyday Irrationality: How Pseudoscientists, Lunatics, and the Rest of Us Fail Think Rationally. Westview Press.

Dawes, R.M. (1988) and (in press 2001). Rational Choice in an Uncertain World. San Diego, CA: Harcourt, Brace, Jovanovich. (Recipient of the William James Award of Division #1 of the American Psychological Association '90). Second edition Hastie, R. & Dawes, R.M., Sage Press.

Swets, J.A., Dawes, R.M., and Monahan, J. (2000). Psychological science can improve diagnostic decisions. Psychological Sciences in the Public Interest (a supplement to Psychological Science), 1, No. 1.

Swets, J.A., Dawes, R.M., and Monahan, J. (2000). Better decisions through science, Scientific American, 283, 4, 70-75.

Dawes, R.M., and messick, D.M. (2000). Social dilemmas. In = International Journal of Psychology. Special Issue on Diplomacy and Pschology, 35, 111-116.

Dawes, R.M. (1998). Behavioral decision making, judgment, and inference. In D. Gilbert, S. Fiske, & G. Lindzey (Eds.), The Handbook of Social Psychology. Boston, MA: McGraw-Hill, 589-597.

Dawes, R.M., and Mulford, M. (1996. The false consensus effect and overconfidence: Flaws in judgment, or flaws in how we study judgment? Organizational Behavior and Human Decision Processes, 65, no. 3, 201-211.

Dawes, R.M. (1994). House of Cards: Psychology and Psychotherapy Built on Myth. New York: The Free Press. Printed in paperback, September 1996.

Dawes, R.M. (1991). Social dilemmas, economic self-interest and evolutionary theory. In D.R. Brown & J.E.K. Smith (Eds.), Recent Research in Psychology: Frontiers of Mathematical Psychology: Essays in Honor of Clyde Coombs. New York: Springer-Verlag, 53-79.

Posted by DSN at 04:25 PM | Comments (0)