« April 2006 | Main | June 2006 »

May 29, 2006

Would you throw good money after bad?

THE PSYCHOLOGY OF SUNK COST

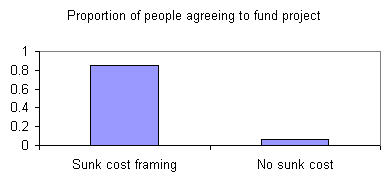

Hal Arkes and Catherine Blumer asked a group of 48 people the following scenario involving sunk costs:

As the president of an airline company, you have invested 10 million dollars of the company’s money into a research project. The purpose was to build a plane that would not be detected by conventional radar, in other words, a radar-blank plane. When the project is 90% completed, another firm begins marketing a plane that cannot be detected by radar. Also, it is apparent that their plane is much faster and far more economical than the plane your company is building. The question is: should you invest the last 10% of the research funds to finish your radar-blank plane, yes or no?

Then asked another group of 60 people this very similar scenario, which one will notice has no sunk costs:

As president of an airline company, you have received a suggestion from one of your employees. The suggestion is to use the last 1 million dollars of your research funds to develop a plane that would not be detected by conventional radar, in other words, a radar-blank plane. However, another firm has just begun marketing a plane that cannot be detected by radar. Also, it is apparent that their plane is much faster and far more economical than the plane your company could build. The question is: should you invest the last million dollars of your research funds to build the radar-blank plane proposed by your employee?

Which did people choose?

Researchers refer to this phenomenon as the "sunk cost effect ... manifested in a greater tendency to continue an endeavor once an investment in money, effort, or time has been made." One could argue that the decision to complete the project shouldn't be influenced by the information which differs between the sunk cost and non-sunk cost scenarios, and yet the data show that the framing matters very much to people.

To see 9 (!) other studies on the sunk cost effect, some involving real-world decisions such as to use pre-paid season tickets, see Arkes and Blumer, below.

Reference:

Arkes, H. R. & Blumer C. (1985). The Psychology of Sunk Cost. Organizational Behavior and Human Decision Processes, 35, 124-140.

Posted by dggoldst at 11:52 AM | Comments (0)

May 21, 2006

How good are your estimation skills?

HARVARD CENTER FOR RISK ANALYSIS QUIZ ON CAUSES OF DEATH

The folks at Risk World let me know about this mini-quiz on odds of various causes of death at Harvard's Center for Risk Analysis.

It's a lot more fun if you take the time before going to that page to complete the following quiz.

The annual risk of dying from the following causes is 1 in ___:

heart disease ___

cancer ___

stroke ___

accidents of all kinds ___

motor vehicle accident ___

Alzheimer’s disease ___

alcohol ___

suicide ___

homicide ___

food poisoning ___

drowning ___

fire ___

bicycle accident ___

lightning ___

bioterrorism ___

Risks of death are a popular topic among judgment and decision making crowd, the most common reference being to:

Slovic, P., B. Fischhoff, and S. Lichtenstein (1982), Facts Versus Fears: Understanding Perceived Risk, in D. Kahneman, P. Slovic, and A. Tversky (eds.), Judgment Under Uncertainty: Heuristics and Biases. Cambridge: Cambridge University Press.

Posted by dggoldst at 11:11 AM | Comments (0)

May 15, 2006

Use of Differential Decision Criteria for Preferred and Nonpreferred Conclusions

WHEN TO STOP INFORMATION SEARCH?

Today's highlight article comes from Dan Gilbert's mention of it in his recent New York Times Op-Ed piece:

"Two psychologists, Peter Ditto and David Lopez, told subjects that they were being tested for a dangerous enzyme deficiency. Subjects placed a drop of saliva on a test strip and waited to see if it turned green. Some subjects were told that the strip would turn green if they had the deficiency, and others were told that the strip would turn green if they did not. In fact, the strip was just an ordinary piece of paper that never changed color.

So how long did subjects stare at the strip before accepting its conclusion? Those who were hoping to see the strip turn green waited a lot longer than those who were hoping not to. Good news may travel slowly, but people are willing to wait for it to arrive.

The same researchers asked subjects to evaluate a student's intelligence by examining information about him one piece at a time. The information was quite damning, and subjects were told they could stop examining it as soon as they'd reached a firm conclusion. Results showed that when subjects liked the student they were evaluating, they turned over one card after another, searching for the one piece of information that might allow them to say something nice about him. But when they disliked the student, they turned over a few cards, shrugged and called it a day."

For over a quarter century we've known that people use heuristics to make decisions. The challenge of the next quarter century is to figure out what governs which heuristics are pulled from the toolbox when. When do we choose between a heuristic that cuts search short and one that digs through information? These kinds of considerations, and not fat (as in overweighted) linear models, are a start.

Reference: Motivated Skepticism: Use of Differential Decision Criteria for Preferred and Nonpreferred Conclusions. Peter H. Ditto and David F. Lopez. Journal of Personality and Social Psychology 1992, Vol. 63, No. 4, 568-584.

Posted by dggoldst at 06:12 AM | Comments (0)

May 09, 2006

Hot topic, low elevation

MOTIVATION AND AFFECT IN DECISION MAKING CONFERENCE, DEAD SEA, ISRAEL, DECEMBER 12-15 2006

Keynote speaker: Nobel Laureate Daniel Kahneman

Venue: Crowne Plaza Hotel, Ein Boqeq, The Dead Sea

Submission deadline: July 10, 2006

The Decision Making and Economic Psychology Center at Ben-Gurion University of the Negev and the Behavioral Decision Making group at the UCLA Anderson School of Management invite submissions of papers for the above conference. The conference will include mostly one-track talks by invited participants. Submitted papers, if accepted, will be assigned to either a parallel session section or a poster session. While most of the invited talks focus on the relationship between affect, motivation, and decision making, submission of papers in other areas of decision making is also possible.

For more information about the program, invited participants, registration and other relevant issues, please consult the conference website, at http://www.bgu.ac.il/~dmep

Posted by dggoldst at 09:58 AM | Comments (0)

May 04, 2006

To live in Barcelona

DECISION SCIENCES TENURE TRACK JOB AT IESE

Spain has some of the finest decision scientists anywhere. Consider living the good life and applying for the following post.

The Decision Sciences department at IESE Business School (Barcelona) invites applications for a tenure track position (assistant professor level). Applicants should have a research interest in managerial decision making, broadly defined, and show ability do mathematical modelling as well as experimental research work. IESE is an international business school with top-ranked MBA and executive programs. The school has campuses in Barcelona and Madrid, and offers regular programs in Munich and Sao Paulo.

Interested candidates should send a cv, research statement, and representative paper/s by E-mail to mbaucells at iese.edu. Candidates should also arrange for two or three letters of recommendation to be sent separately. Review of materials will begin on May, 5th, 2006, and will continue until the position is filled.

Posted by dggoldst at 11:26 AM | Comments (0)